Normal Profits Tax: Regular gold IRA distributions are issue to ordinary cash flow tax as opposed to capital gains taxes, a significant difference If the gold has significantly appreciated during its time held by you.

Selecting the best gold IRA firm is a private option that ought to be according to numerous components including the company’s reputation, expertise, metal prices, fees etc. However, inside our study we discovered this company to be the best.

Classic IRA: Contributions may be tax-deductible determined by somebody’s revenue and usage of an employer-sponsored retirement prepare; earnings increase tax deferred until finally withdrawals start out (normally immediately after reaching retirement age).

But locating the best gold investment enterprise that will help you make the leap? That’s exactly where it will get challenging.

IRA companies like Noble Gold may perhaps shed light-weight on matters like their functionality, Added benefits, and hazards as well as distinctions involving traditional or Roth IRAs.

For our rankings, we despatched a electronic survey, consisting of over twenty queries, to each enterprise that we reviewed. Our researchers verified the study details and verified any missing info points by contacting Each individual company straight and by means of on-line study.

Since the IRS has demanding demands with regards to purity and provenance of coins prior to order for an IRA account. Generally validate their IRA metal eligibility initial!

A Gold IRA custodian is often a certified get together that's in charge of storing your gold for your gold IRA. For a number of motives, the federal governing administration needs that you choose to keep your IRA metals with an expert custodian. Usually gold IRA property storage just isn't a real choice.

Changing from the 401(k) right into a Gold IRA might be an beneficial strategy for those searching for to diversify their retirement portfolio and shield it against economic uncertainties, some sort of lifetime insurance plan in opposition to inflation.

A great way to integrate gold into your retirement portfolio is thru rolling more than read more your 401(k) into a Gold IRA. We will explore each stage concerned below within our posting.

Empowering Final decision Earning: Perfectly-educated buyers Expert-approved bullion investments are much better ready to make conclusions that align with their financial objectives, thanks to academic assets which equip buyers with information about examining the potential positives and negatives of which includes gold in retirement portfolios, current market tendencies and building conclusions based on information as opposed to thoughts or hoopla.

Portion of preserving for retirement is securing your investments versus the longer term. Gold and precious metals are fantastic investments to secure your long term from alterations from the financial earth, so as a secondary retirement account it is great choice for Lots of people.

When picking out a gold bar for an IRA account it’s necessary that they come from accredited producers regarded by companies including the London Bullion Marketplace Affiliation or very similar bodies being acknowledged as IRA gold.

An acceptable Gold IRA rollover service provider will not only have the network in place to facilitate the whole initiation, transportation, and operation demanded, but they're going to provide the expertise and knowledge needed to do it in a timely, seamless, and easy fashion.

Edward Furlong Then & Now!

Edward Furlong Then & Now! Neve Campbell Then & Now!

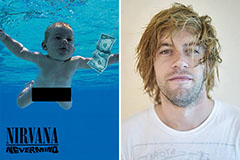

Neve Campbell Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Alisan Porter Then & Now!

Alisan Porter Then & Now!